What is kvant

kvant is a sovereign swiss cloud and AI platform offering exceptional availability, scalability, and security. Strategically located zones in Zurich and Basel provide robust infrastructure, supported by trusted partners and regulatory compliance for secure business transformation.

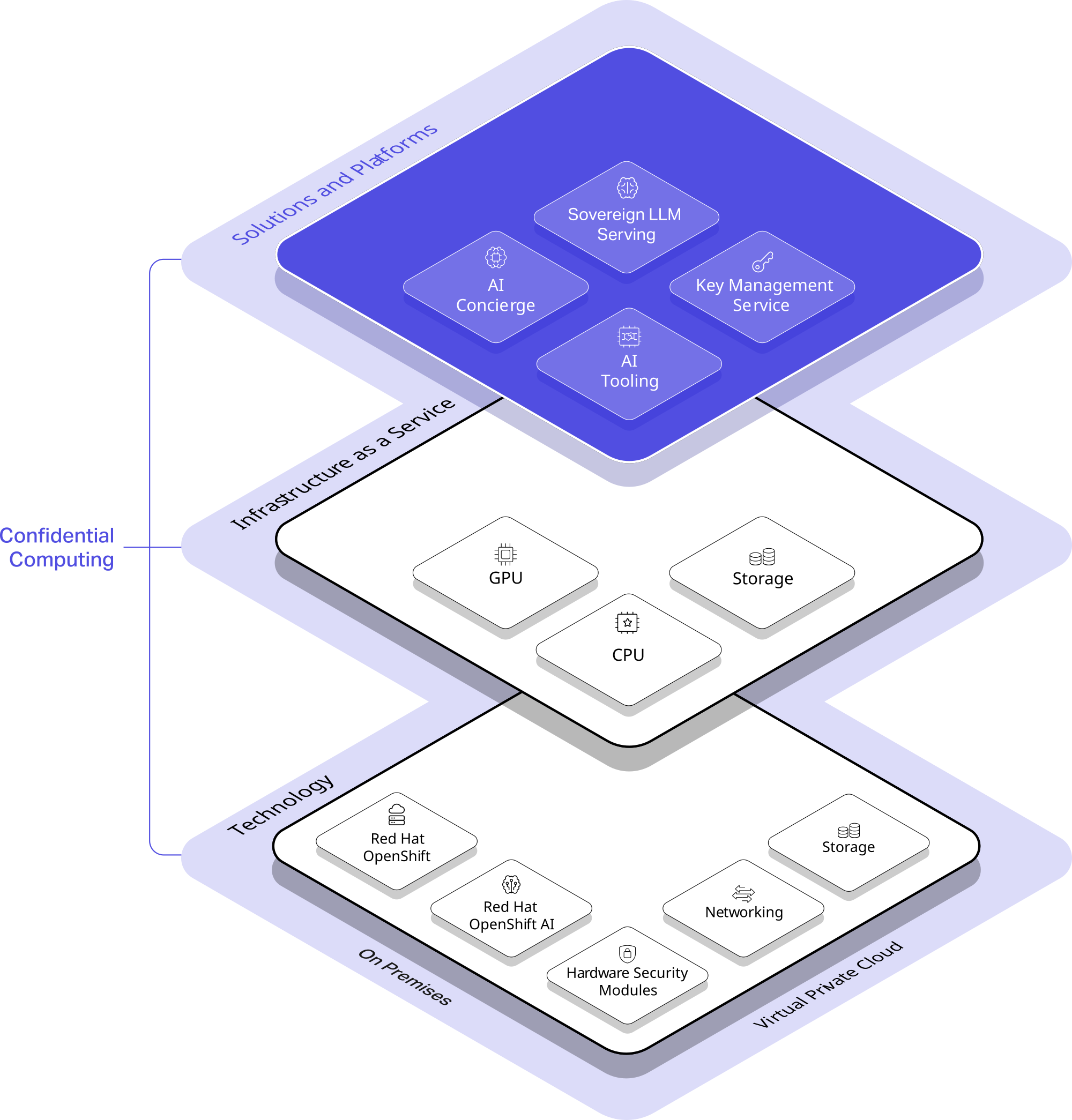

Solutions and Platforms

Solutions and Platforms empower enterprises to securely build, deploy, and manage AI applications within a sovereign cloud environment. From conversational AI and LLM hosting to advanced tooling and key management, kvant delivers end-to-end capabilities for compliant and scalable AI innovation.

Infrastructure as a Service

Infrastructure as a Service provides sovereign, high-performance infrastructure with scalable GPU, CPU, and NVMe storage resources. Designed for demanding workloads, it ensures security, reliability, and full control across compute and data layers.

Technology

kvant combines Red Hat OpenShift, HSMs, high-speed storage, and secure networking to deliver a powerful and compliant cloud-native foundation. It can be consumed flexibly—either on-premise or via Virtual Private Cloud—ensuring full sovereignty and control in any deployment model.

Solutions and Platforms

Infrastructure as a Service

Technology

Red Hat OpenShift

Red Hat OpenShift is a leading enterprise Kubernetes platform that enables the deployment, management, and scaling of containerized applications across hybrid and multi-cloud environments. Integrated with advanced security, developer tools, and automation, it streamlines application delivery while ensuring operational consistency and compliance.

Red Hat OpenShift AI

Red Hat OpenShift AI is an integrated platform for building, training, deploying, and managing AI models at scale within Kubernetes environments. It combines the flexibility of open-source tools with enterprise-grade security, automation, and lifecycle management for end-to-end AI workflows.

Hardware Security Modules

Hardware Security Modules (HSMs) are physical devices that securely generate, store, and manage cryptographic keys to protect sensitive data and digital assets. Integrated into Phoenix Technologies’ sovereign infrastructure, they ensure tamper-proof encryption operations, regulatory compliance, and full control over key usage.

Networking

Networking at Phoenix leverages Software Defined Networking (SDN) to isolate virtual data centers, manage traffic intelligently, and scale bandwidth up to 100 Gbps. This ensures secure, high-performance connectivity across cloud resources while maintaining full control and compliance.

Storage

Storage at Phoenix offers high-speed NVMe performance with built-in backups and snapshots for seamless scalability and data resilience. Distributed across four availability zones and featuring an air-gapped location, it ensures secure, sovereign data protection for critical workloads.

On Premises

kvant is also available as an on-premise solution, allowing you to deploy the full sovereign cloud and AI platform directly in your own data center. This setup ensures maximum control, security, and compliance—ideal for sensitive or regulated environments requiring air-gapped infrastructure.

Virtual Private Cloud

kvant Virtual Private Cloud (VPC) offers isolated, secure cloud environments tailored to individual organizations, ensuring full data separation and control. Built on sovereign infrastructure, each VPC provides dedicated compute, storage, and networking resources with support for confidential computing and regulatory compliance.

Confidential Computing

Our Confidential Computing approach transforms cloud security by safeguarding data at rest, in transit and in use. With encrypted enclaves, we ensure sensitive information remains confidential even in shared environments. This paradigm shift sets a new standard for secure data processing in the cloud.

Products

Partners

Industry-leading experts leverage best in class technology to drive impactful connections, sparking transformation and creating value. The kvant partner network strategically connects people, data, and resources to accelerate your goals and empower your vision.